Exit multiple что это

Exit Multiple: What is it?

Expertise: Investment Banking | Private Equity

An exit multiple is one of the methods used to calculate the terminal value (TV) as an input to the discounted cash flow (DCF) formula which in turn is used to arrive at the current value of the business in question. An exit occurs when an owner or investor decides to end their involvement with a business, most often by selling their ownership stake to other investors. The most commonly used multiple is EV/EBITDA, which is known as the enterprise multiple. The method assumes that the value of a business can be determined at the end of a projected period or at the ‘exit’, based on the existing public market valuations of comparable companies within an industry. It is also referred to as terminal exit value.

The concept of an exit multiple is similar to that of an

Future Value = (Present value) x (1 + rate of return) ^ time

n here calculates to around 25% which is the annual rate of return required to justify the multiple required by the investor of 3x

Understanding the exit multiples method of valuation

A multiple, also called a multiplier, is a valuation technique that calculates the value of a business or company relative to a financial metric. Multiples are used to compare businesses operating in similar environments such as the same sector to determine whether a company is reasonably priced, as compared to its peers. There are numerous types of multiples that can be used, a few of which include EV/EBITDA, EV/Sales, EV/EBIT, P/BV, and P/E multiples. However, the most commonly used multiples are EV/EBITDA and EV/EBIT as they provide a direct relationship between enterprise value in relation and the profits of the company which in most cases can be standardized.

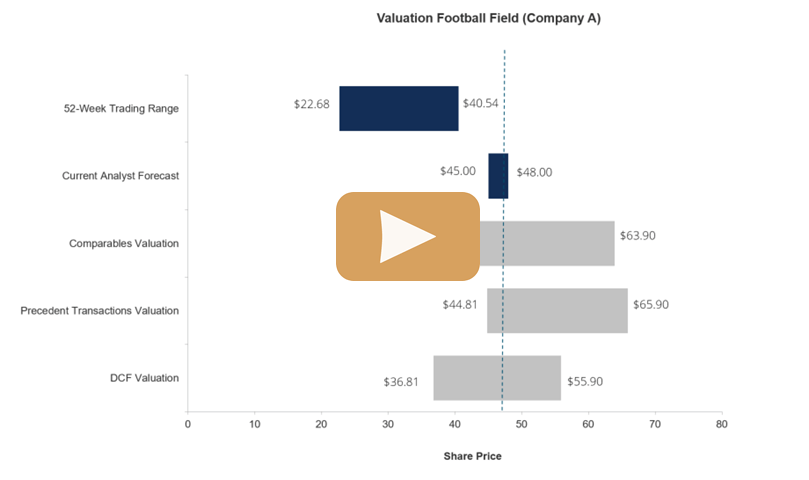

Below is a video from our valuation course that covers this concept in more detail.

What is EV/EBITDA exit multiple?

EV/EBITDA, or the enterprise multiple, is a financial ratio that compares a company’s Enterprise Value (EV) to its Earnings Before Interest, Tax, Depreciation, and Amortization (EBITDA).

The ratio is used to compare the entire value of the business with the amount of EBITDA it generates on an yearly basis. It tells investors how many multiples of EBITDA they have to pay, were they to acquire the entire business, which makes it a useful metric for

The ratio is used to compare the entire value of the business with the amount of EBITDA it generates on a yearly basis. It tells investors how much time the EBITDA they have to pay if they are to acquire the entire business, which makes it a useful metric for private equity (PE) investors. Generally, analysts and investors consider an EV/EBITDA value below 10 as healthy and above average. However, the enterprise multiple can vary significantly depending on the industry. It can be expected that high-growth industries such as biotech have higher enterprise multiples compared to industries with slow growth such as manufacturing. For this reason, the comparison of relative values among companies within the same industry is the best way for investors to determine companies with the healthiest EV/EBITDA within a specific sector. For example, if two companies operating in the same industry with similar business operations trade at EV/EBITDA multiples of 12x and 8x respectively, with other factors assumed to be the same, the company with an 8x EV/EBITDA multiple is deemed undervalued and cheaper by investors. As such, it may be more attractive to invest in the latter company as it appears to be a better ‘bargain’. Below are some more examples of what the EV/EBITDA multiple is used for in finance:

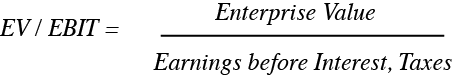

What is EV/EBIT exit multiple?

EV/EBIT is a financial ratio that compares a company’s Enterprise Value (EV) to its Earnings Before Interest and Tax (EBIT) and is a common indicator of value in relation to the profitability of a company. The EV/EBIT is a similar ratio to Price to Earnings (P/E), as it also measures if a business is priced too high or too low in comparison to similar stocks and the market as a whole. However, EV/EBIT makes up for certain shortfalls of P/E. Enterprise value (EV) accounts for a truer value of the company by considering more factors than the company’s market capitalization, the primary one being debt. The ratio is particularly useful for comparing a company with its competitors within the wider market.

company with its competitors within the wider market. A high EV/EBIT indicates that a company’s stock may be overvalued, while a low ratio indicates that it may be undervalued relative to its peers. Investors generally view a lower EV/EBIT as a more attractive sign to invest into a company, as it means that share prices are lower than the fair value of the business. Eventually, when the market attaches a more appropriate value to the company, investors would expect the share price to climb. In contrast, a high EV/EBIT may be an indication for investors to exit their investment or to

A high EV/EBIT indicates that a company’s stock may be overvalued, while a low ratio indicates that it may be undervalued relative to its peers. Investors generally view a lower EV/EBIT as a more attractive sign to invest in a company, as it means that share prices are lower than the fair value of the business. Eventually, when the market attaches a more appropriate value to the company, investors would expect the share price to climb. In contrast, a high EV/EBIT may be an indication for investors to exit their investment or to short the stock. Like EV/EBITDA, EV/EBIT is a useful financial ratio to determine a target price (in an equity research report) or to value a company in comparison to its competitors. For example, let’s assume that a financial analyst is required to determine the share price of Company X, which is to go public through an initial public offering (IPO). There are four other similar-sized companies namely, Companies V, X, Y, and Z that operate in the same industry. The EV/EBIT for the companies is 13.2x, 5.1x, 9.5x, and 11.7x, respectively. The average EV/EBIT ratio out of the four competitors is 9.88x. As a result, a financial analyst would use the 9.88x multiple as a guide to finding the EV of Company X by multiplying it to the EBIT, and therefore, its equity value and share price.

EV/EBITDA vs EV/EBIT: What is the difference?

Both EV/EBITDA and EV/EBIT are popular financial ratios that essentially measure the value of a company in relation to its profits. However, while EV/EBITDA is used to calculate the fair market value of a company through the measurements of the company’s finance and investments, EV/EBIT indicates whether a company’s valuation is cheap or expensive relative to competitors or the wider market. The major difference between the two metrics is that EV/EBIT includes depreciation and amortization, which is particularly useful while analyzing capital-intensive businesses where depreciation is a true economic cost. Some examples of capital-intensive industries include automobile manufacturing, energy, steel production, and telecommunications. Therefore, in such capital-intensive industries, EV/EBIT may produce a more reliable valuation than EV/EBITDA.

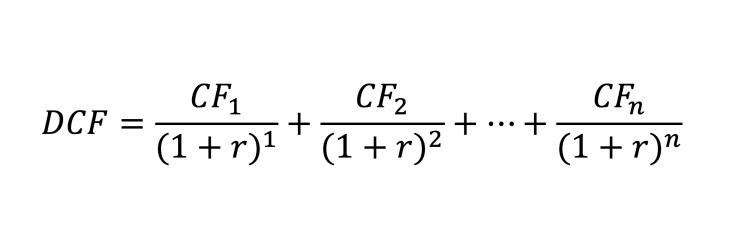

What is discounted cash flow?

Estimating a company’s cash flow well into the future and then deriving its value is not an easy task. To solve this, analysts use various financial models such as discounted cash flow (DCF) which is a method based on the assumption that a company’s value is equivalent to the present value of all its future cash flows. These cash flows are generally discounted to present value using the company’s Weighted Average Cost of Capital (WACC). Here’s a look at the DCF formula:

CF = cash flow for each consecutive period

R = discount rate (usually WACC)

N = time of cash flow (in years)

DCF has two major components: the forecast period and

DCF has two major components: the forecast period and terminal value (TV). The forecast period is usually limited to around five years as anything longer makes the projections less accurate. This is where terminal value comes in handy.

What is Terminal Value (TV)?

Terminal value (TV) is the value of a company, project, or asset into perpetuity when future cash flows can be estimated. It assumes that a business will grow at a constant rate forever after the forecast period. There are two commonly used methods to calculate terminal value: Exit multiple and Perpetual Growth Method (Gordon Growth Model).

Calculating terminal value using exit multiples

How do we calculate terminal value for cyclical businesses?

For cyclical businesses where earnings fluctuate depending on time and other factors affecting the economy such as airlines, automobile manufacturers and hotel chains, the average EBITDA or EBIT during the course of the specific cyclical year is used rather than the amount in year N in the projection period. For this reason, an industry multiple is applied rather than applying a current multiple to account for the cyclical variations of earnings. If a current multiple was used instead, the valuation of the business would be skewed by fluctuations in the economic cycle.

What is a normal exit multiple?

While there is no such thing as a ‘normal’ standalone multiple, an appropriate range of multiples can be generated by looking at recent comparable acquisitions in the public market. Below is a table of rough EBITDA multiples by sector in the United States (source: Ashwath Damodaran’s datasets). Examples of EBITDA Multiples by Sector are given in the table below:

| Sector | EBITDA multiple |

|---|---|

| Aerospace/Defence | 15.98 |

| Apparel | 14.14 |

| Computer Services | 11.55 |

| Education | 19.39 |

| Farming/Agriculture | 17.87 |

| Information Services | 33.16 |

| Steel | 8.01 |

| Tobacco | 11.25 |

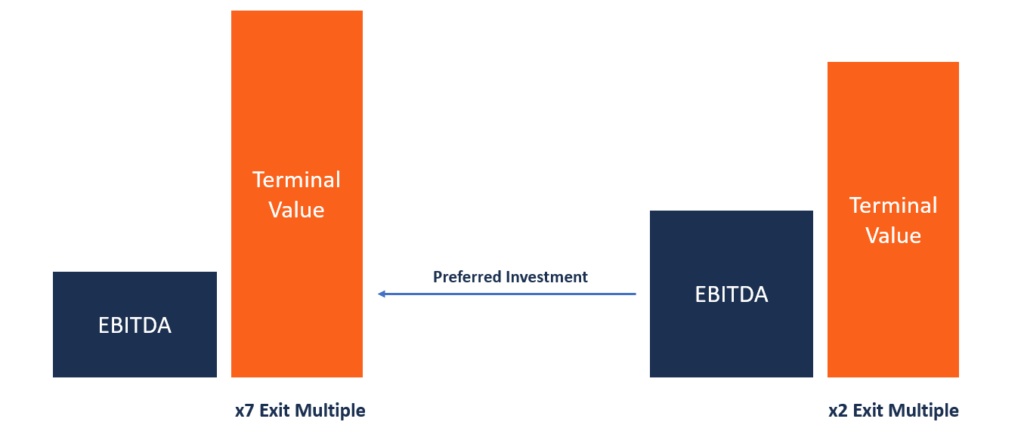

What is an entry multiple?

An entry multiple is quite simply the opposite of an exit multiple. Commonly used in leveraged buyouts, an entry multiple refers to the price paid for a company as a function of a financial metric such as EV/EBITDA. The entry multiple is especially important for private equity (PE) firms, as it helps them determine the purchase price of a company relative to a financial metric. Ideally, PE firms want to purchase companies at low entry multiples to maximize their returns. An entry multiple is typically compared to an exit multiple. While an entry multiple is a price paid for a company relative to a financial metric, an exit multiple is simply the sale price of a company relative to a financial metric.

An entry multiple is quite simply the opposite of an exit multiple. Commonly used in leveraged buyouts, an entry multiple refers to the price paid for a company as a function of a financial metric such as EV/EBITDA. The entry multiple is especially important for

Here is a short video that outlines the difference between an entry multiple and exit multiple:

Terminal Value

What is Terminal Value?

What is the Importance of the Terminal Value?

In financial analysis, the terminal value includes the value of all future cash flows Valuation Methods When valuing a company as a going concern there are three main valuation methods used: DCF analysis, comparable companies, and precedent transactions outside of a particular projection period. It captures values that are otherwise difficult to predict using the regular financial model forecast period. There are two methods used to calculate the terminal value, which depends on the type of analysis to be done.

The perpetuity growth model assumes that cash flow values grow at a constant rate ad infinitum. Because of this assumption, the formula for perpetuity with growth can be used. The perpetuity growth model is preferred among academics as there is a mathematical theory behind it. However, it is difficult to agree on the assumptions that will predict an accurate perpetual growth rate.

Terminal Value: Exit Multiple Method

Terminal value is calculated based on what method (discussed previously) the analyst is going to use. Under the exit multiple method, TV is calculated as follows:

TV = Last Twelve Months Exit Multiple x Projected Statistic

Terminal Value: Perpetuity Growth Model

Meanwhile, under the perpetuity growth model, the terminal value is calculated as follows:

TV = (Free Cash Flow x (1 + g)) / (WACC – g)

Perpetuity growth rate is usually equivalent to the inflation rate and almost always less than the economy’s growth rate. If the growth rate changes, a multiple-stage terminal value can then be determined instead.

What are the Limitations of Using the Terminal Value?

As mentioned previously, the perpetuity growth model is limited by the difficulty of predicting an accurate growth rate. Furthermore, any assumed value in the equation can lead to inaccuracies in the calculated terminal value. On the other hand, the exit multiple method is limited by the dynamic nature of multiples – they change as time passes.

All in all, careful considerations must be in place before applying any of the two methods. But for both methods, using a range of applicable rates and multiples is important in order to get an acceptable valuation result.

Additional Resources

CFI is the official provider of the global Financial Modeling & Valuation Analyst (FMVA)® Become a Certified Financial Modeling & Valuation Analyst (FMVA)® CFI’s Financial Modeling and Valuation Analyst (FMVA)® certification will help you gain the confidence you need in your finance career. Enroll today! certification program, designed to help anyone become a world-class financial analyst.

Through financial modeling courses, training, and exercises, anyone in the world can become a great analyst. To keep advancing your career, the additional CFI resources below will be useful:

Valuation Techniques

Learn the most important valuation techniques in CFI’s Business Valuation course!

Step by step instruction on how the professionals on Wall Street value a company.

the easy way with templates and step by step instruction!

Exit Multiple

What is an Exit Multiple?

Analysts use exit multiples to estimate the value of a company by multiplying financial metrics such as EBIT EBIT Guide EBIT stands for Earnings Before Interest and Taxes and is one of the last subtotals in the income statement before net income. EBIT is also sometimes referred to as operating income and is called this because it’s found by deducting all operating expenses (production and non-production costs) from sales revenue. and EBITDA EBITDA EBITDA or Earnings Before Interest, Tax, Depreciation, Amortization is a company’s profits before any of these net deductions are made. EBITDA focuses on the operating decisions of a business because it looks at the business’ profitability from core operations before the impact of capital structure. Formula, examples by a factor that is similar to that of recently acquired companies. Exit multiple is sometimes referred to as terminal exit value.

What is Terminal Value?

Terminal value refers to the value of a project or business at a future point in time beyond the explicit forecast period. Instead, it assumes that the growth rates of all future cash flows are consistent and stable beyond the forecast period. Terminal value is typically a large portion (>50%) of the total assessed value and is therefore very important.

Terminal value addresses such limitations by allowing the inclusion of future cash flow values beyond the projection period while mitigating any issues that may arise from using the values of such cash flows.

Using Discounted Cash Flows Method to Determine Terminal Value

When estimating a company’s cash flows in the future, analysts use financial models such as the discounted cash flow (DCF) Discounted Cash Flow DCF Formula This article breaks down the DCF formula into simple terms with examples and a video of the calculation. Learn to determine the value of a business. method combined with certain assumptions to arrive at the value of the business. The DCF method assumes that the asset value equals the future cash flows generated by that asset.

The discounted cash flow method comprises two main components, i.e., the forecast period and terminal value. The forecast period is used when estimating the value of a company or asset for a period of about three to five years.

Using the forecast period to determine the value of a company for a period exceeding five years will cast doubt on the accuracy of the valuation obtained. Using terminal value to find the value of a company or asset attempts to solve this uncertainty. There are two approaches to calculating terminal values: Exit Multiple and Perpetual Growth method.

Calculating Terminal Value Using Exit Multiple

The exit multiple uses a market multiple basis to fairly value a business. The value of the business is obtained by multiplying financial metrics such as EBITDA or EBIT by a factor obtained from comparable companies that were recently acquired. An appropriate range of multiples can be generated by looking at recent comparable acquisitions in the public market.

The multiple obtained is then multiplied by the projected EBIT or EBITDA in year N (final year of projection period) to give the future value at the end of year N. The future value (also known as terminal value) is then discounted back using a company’s Weighted Average Cost of Capital.

This means that an industry multiple is applied rather than applying a current multiple to take into account the cyclical variations of earnings. If analysts used a current multiple, the valuation would be affected by economic cycles.

Perpetual Growth Method

The perpetual growth method is an alternative to the exit multiple method, and it accounts for the free cash flows of a business that grow at a steady rate in perpetuity. It assumes that cash will grow at a stable rate forever, starting from a specific point in the future.

While it is nearly impossible for a company to grow at the same rate for an infinite period in the future, the perpetual growth method is preferred to calculating the terminal value because it is based on the historical performance of the company.

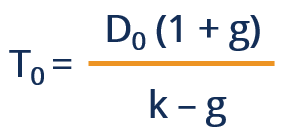

Compared to the exit multiple method, the perpetual growth method generates a higher terminal value. The formula for calculating the terminal value using the perpetual growth method is as follows:

Additional Resources

CFI is the official provider of the global Financial Modeling & Valuation Analyst (FMVA)® Become a Certified Financial Modeling & Valuation Analyst (FMVA)® CFI’s Financial Modeling and Valuation Analyst (FMVA)® certification will help you gain the confidence you need in your finance career. Enroll today! certification program, designed to help anyone become a world-class financial analyst. To keep advancing your career, the additional CFI resources below will be useful:

Financial Analyst Training

Gain the confidence you need to move up the ladder in a high powered corporate finance career path.

Learn financial modeling and valuation in Excel the easy way, with step-by-step training.

Оценка терминальной стоимости: мультипликаторы и модель Гордона >

FCF – свободный денежный поток

Terminal Value – терминальная стоимость

В этой статье обсуждаются 2 метода :

1) Мультипликаторы EBITDA (Exit multiples)

3) Модель Гордона ( Gordon growth model)

ОЦЕНКА ТЕРМИНАЛЬНОЙ СТОИМОСТИ С ПОМОЩЬЮ МУЛЬТИПЛИКАТОРА

Терминальное значение = EBITDA * Мультипликатор

МОДЕЛЬ ГОРДОНА (GORDON GROWTH MODEL)

Модель Гордона, основанный на постоянном стабильном росте, предполагает, что свободный денежный поток ( free cash flow) продолжит расти с постоянной скоростью до бесконечности. Терминальную стоимость можно оценить, используя следующую формулу:

TV – терминальная стоимость

FCFt – свободный денежный поток последнего периода

g – постоянный устойчивый темп роста

Какой темп роста g использовать при моделировании? Темп роста прошлых периодов не всегда является надежным показателем будущего роста, однако существует корреляция между текущим и будущим ростом. Бизнес, который в настоящее время растет на уровне 10%, вероятно, имеет более высокий стабильный темп роста и более длительный период роста, чем тот, который сейчас растет на 5 % процентов в год.

При вычислении TV с помощью метода дисконтированных денежных потоков DCF необходимо иметь ввиду следующее :

— Рассчитайте денежный поток FCF или EBITDA в последний год прогнозируемого периода. Обычная ошибка заключается в том, что начинающие аналитики применяют мультипликатор к EBITDA за последний квартал (который для многих компаний падает ввиду циклических особенностей), вместо того, чтобы суммировать значения за последний год прогнозируемого периода.

— Не забывайте в конце расчетов сложить TV и денежные потоки прогнозируемого периода для получения Enterprise Value.

exit multiple

The sale price of £71 million represents an historic exit multiple of 9.5 times profit before interest, taxation and depreciation. — Цена продажи в размере £71 млн. представляет собой произведение исторического конечного кратного (равного 9,5) и прибыли до вычета процентов, налогов и амортизации.

Полезное

Смотреть что такое «exit multiple» в других словарях:

Exit number — On a road with distance based exit numbering, the exit number (shown here on a gore sign) matches a nearby mile or kilometer marker … Wikipedia

Multiple-prism dispersion theory — The first description of multiple prism arrays, and multiple prism dispersion, was given by Newton in his book Opticks.[1] Prism pair expanders were introduced by Brewster in 1813.[2] A modern mathematical description of the single prism… … Wikipedia

EXIT (festival) — infobox music festival music festival name = EXIT festival location = flagicon|Serbia Novi Sad, Serbia years active= 2000 present founders = Dušan Kovačević and Bojan Bošković dates = Four days, starting on the first Thursday of July genre = Rock … Wikipedia

Exit sign — An exit sign is a device in a public facility (such as a building, airplane or boat) that displays where the emergency exit is. Most exit signs around the world are in pictogram form, with or without text supplement. There has been a shift… … Wikipedia

Exit Ten — Infobox Musical artist Name = Exit Ten Img capt = Img size = Landscape = Background = group or band Alias = Origin = Reading, Berkshire, United Kingdom Genre = Progressive metal Melodic Metalcore Years active = 2003–present Label = Deep Burn,… … Wikipedia

Multiple citizenship — Legal status of persons Concepts Citizenship Immigration Illegal immigration Nationality Naturalization Leave to Remain Statelessness Designations … Wikipedia

Exit Strategy (Arrested Development episode) — Infobox Arrested Development episode episode name = Exit Strategy episode no = 3AJD12 airdate = February 10, 2006 writer = Mitchell Hurwitz and Jim Vallely director = Rebecca E. Asher on the next = “Tobias gives his daughter the gift he’d stayed… … Wikipedia

Multiple-vehicle collision — Pileup redirects here. For other uses, see Pileup (disambiguation). A multi vehicle collision (colloquially known as a pile up) is a road traffic accident involving many vehicles. Generally occurring on high capacity and high speed routes such as … Wikipedia

Exit & Entry Permit (Taiwan) — An Exit Entry Permit (Traditional Chinese: 中華民國台灣地區入出境許可證, more commonly known as 台證 or 入台證) is a document issued by the Immigration Office of the National Police Agency of the Republic of China, for Hong Kong and Macau residents holding PRC… … Wikipedia

MTV EXIT — BackgroundThe MTV EXIT (End Exploitation and Trafficking) campaign is a multimedia initiative produced by the MTV Europe Foundation to raise awareness and increase prevention of human trafficking. The MTV Europe Foundation is a registered UK… … Wikipedia

California High School Exit Exam — The California High School Exit Exam (or CAHSEE) is a requirement for high school graduation in the state of California, created by the California Department of Education to improve the academic performance of California high school students, and … Wikipedia

.png)